The Ultimate Guide To Paul B Insurance Medicare Agent Near Me

Table of ContentsPaul B Insurance Medicare Agent Near Me for DummiesPaul B Insurance Medicare Part D for DummiesNot known Details About Paul B Insurance Medicare Supplement Agent A Biased View of Paul B Insurance Medicare Advantage AgentThe Definitive Guide for Paul B Insurance Medicare Advantage AgentGetting My Paul B Insurance Medicare Part D To WorkWhat Does Paul B Insurance Best Medicare Agent Near Me Do?The Basic Principles Of Paul B Insurance Medicare Agent Near Me

You do not need to pick a medical care doctor. You can go outside of the network, but you will pay higher deductibles and copayments when you do. This is a managed care plan with a network of suppliers. The suppliers administer the strategy and take the financial danger. You select a medical care physician and consent to use plan companies.This is an insurance strategy, not a handled care plan. The plan, not Medicare, sets the cost schedule for suppliers, but suppliers can bill as much as 15% more. You see any companies you choose, as long as the provider concurs to accept the payment schedule. Medical requirement is identified by the plan.

How Paul B Insurance Best Medicare Agent Near Me can Save You Time, Stress, and Money.

This is one of the handled care strategy types (HMO, HMO w/pos, PPO, PSO) which is formed by a religious or fraternal company. These plans may limit enrollment to members of their organization. This is a medical insurance policy with a high deductible ($3,000) combined with a cost savings account ($2,000).

You can use the cash in your MSA to pay your medical expenses (tax totally free). You have free choice of service providers. The providers have no limitation on what they charge. Guaranteed Concern: The plan should enlist you if you meet the requirements. Care should be readily available 24 hours daily, seven days a week.

The Paul B Insurance Medicare Agent Near Me Statements

Physicians must be enabled to inform you of all treatment choices. Paul B Insurance Medicare Agent Near me. The strategy needs to have a complaint and appeal treatment. If a layperson would think that a symptom could be an emergency situation, then the strategy needs to spend for the emergency treatment. The plan can not charge more than a $50 copayment for sees to the emergency clinic.

Paul B Insurance Best Medicare Agent Near Me - The Facts

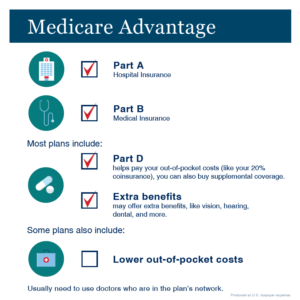

You pay any plan premium, deductibles, or copayments. All plans may offer extra benefits or services not covered by Medicare. There is generally less documentation for you. The Centers for Medicare and Medicaid Solutions (Medicare) pays the plan a set amount for each month that a beneficiary is enrolled. The Centers for Medicare and Medicaid Providers keeps track of appeals and marketing plans.

If you satisfy the following requirements, the Medicare Advantage plan should register you. You have Medicare Part A and Part B.You pay the Medicare Part B premium.

Excitement About Paul B Insurance Medicare Part D

You are not receiving Medicare due to end-stage kidney disease. You have Medicare Part A and Part B, or just Part B.You pay the Medicare Part B premium.

Medicare Benefit plans should provide all Medicare covered services and are approved by Medicare. Medicare Advantage strategies may supply some services that Medicare does not normally cover, such as routine physicals and foot care, oral care, eye examinations, prescriptions, hearing aids, and other preventive services. Medicare HMOs might offer some services that Medicare doesn't generally cover, such as routine physicals and foot care, dental care, eye tests, prescriptions, hearing help, and other preventive services.

The Greatest Guide To Paul B Insurance Medicare Advantage Plans

You do not need a Medicare supplement policy. You have no expenses or claim kinds to complete (Paul B Insurance Best Medicare Agent near me). Filing and organizing of claims is done by the Medicare Benefit plan. You have 24-hour access to services, consisting of emergency or immediate care with providers beyond the network. This consists of foreign travel not covered by Medicare.

The Medicare Benefit strategies should enable you to appeal rejection of claims or services. If the service is still rejected, then you have other appeal rights with Medicare. You should live within the service area of the Medicare Benefit plan. If you move outside of the service location, then you must join a various plan or get a Medicare supplement policy to choose your Initial Medicare.

How Paul B Insurance Medicare Part D can Save You Time, Stress, and Money.

A company might leave the plan, or the plan's contract with Medicare could be canceled. You would have to find another Medicare Benefit strategy or get a Medicare Supplement Policy to go with your Initial Medicare. If your Medical Care Doctor (PCP) leaves the discover here plan, then you would need to choose another PCP.If you live outside of the plan area for 12 or more months in a row, the Medicare Advantage strategy might ask you to disenroll and re-enroll when you go back to the location.

Paul B Insurance Medicare Agent Near Me for Dummies

These defenses will make it possible for beneficiaries, in certain situations, to try a plan, however then return to Original Medicare and a Medicare Supplement policy if they wish visit the site to do so. Paul B Insurance Medicare advantage plans. Under these defenses, recipients will have warranty concern of a Medicare Supplement policy as long as they fulfill among the following requirements.

To get these defenses, recipients need to use for a supplement policy within 63 days of disenrolling from the health strategy, or within 63 days of the termination of the health plan. A beneficiary would be eligible for the Medicare Supplement protections if they fulfill among the following requirements.